-

Posts

2,891 -

Joined

-

Last visited

-

Days Won

127

Content Type

Profiles

Forums

Events

Downloads

Everything posted by megilleland

-

Picturesque Brecon Beacons town's high street is named the best in the UK - and it prides itself on having ZERO chain stores * Crickhowell, on the edge of the Brecon Beacons, was named winner of the Great British High Street Awards * Judges were wowed by the bustling street in the picturesque town, which is full of family-run, independent shops * To stop large national chains taking over, 267 residents even collectively bought a pub due to close down Lessons to learn here?

-

Jesse Norman tweeted today: Whatever anyone may feel about #Brexit, or about the detail of this deal, it’s the only deal on the table. Or remotely likely to be on the table. And the general public understand that.

-

Herefordshire Council Herefordshire Council Contracts

megilleland replied to Aylestone Voice's topic in Open Forum

It appears the Cabinet have decided there is no need for any meetings until 13th/20th December, cancelling 6 of them since September. Do they still get their allowances paid for doing nothing? -

Herefordshire Council Additional Funding for Road Repairs and Potholes

megilleland replied to Hereford Voice's topic in Open Forum

I sent an email to BBLP on 9th October concerning the ownership of a verge which has yet to be cut this year and a reminder on the 13th November and I am still waiting for a reply. -

Most of these companies are already registered overseas Jaguar Land Rover Automotive PLC is the holding company of Jaguar Land Rover Limited, a British multinational automotive company with its headquarters in Whitley, Coventry, United Kingdom, and a subsidiary of Indian automotive company Tata Motors. Vauxhall Motors Limited is a British car manufacturer, which is a fully owned subsidiary of German car manufacturer Opel, which in turn is owned by Groupe PSA of France. BMW is a German multinational company which currently produces luxury automobiles and motorcycles, and also produced aircraft engines until 1945. The company was founded in 1916 and has its headquarters in Munich, Bavaria. Ford Motor Company is an American multinational automaker headquartered in Dearborn, Michigan, a suburb of Detroit. Nissan Motor Company Ltd, usually shortened to Nissan, is a Japanese multinational automobile manufacturer headquartered in Nishi-ku, Yokohama. I think these companies want to take the innovations created by UK workers, but don't want to pay the taxes - most take their profits home or put them offshore. Strangely J.C. Bamford Excavators Limited, universally known as JCB, is an English multinational corporation, with headquarters in Rocester, Staffordshire The chairman of the digger company JCB was among the prominent financial backers of the Vote Leave campaign, and has repeatedly said his company can prosper just as well outside the EU as it does within it. Lord Bamford has said that he voted to stay in the common market in 1975, yet did not vote for political union. He quit the Confederation of British Industry lobby group saying it had ignored the voice of smaller businesses opposed to the EU and had become the voice of multinational firms. JCB was fined €39.6m (£35.5m) by the European commission in 2000 for antitrust breaches. A major Conservative Party donor, Bamford believes the UK could strike trade deals around the world for the benefit of British businesses. and 28 June 2018 JCB is investing £50m in building a new factory at its Staffordshire base that will create hundreds of skilled jobs. The company best known for its bright yellow diggers aims to open the new plant next summer. It will build cabs for JCB’s plant equipment. Graeme Macdonald, chief executive of the privately owned company, described the investment as one of the largest in JCB’s history.

-

Michel Barnier (left) and Donald Tusk hold a copy of the draft Brexit agreement (Daily Express) "Peace in our time".

-

Ragwert. Is it shatterproof?

-

13/11/2018 Herefordshire Council Development and regeneration programme Hereford Football Stadium refurbishment preliminary appraisal Recommendations Approved (subject to call-in) Decision details Development and regeneration programme Hereford Football Stadium refurbishment preliminary appraisal Decision Maker: Cabinet member contracts and assets Decision status: Recommendations Approved (subject to call-in) Is Key decision?: No Is subject to call in?: Yes To approve the scope and cost of the first stage of appraisal services to be provided by the council’s developer partner, Engie Regeneration, in respect of a potential project to refurbish and redevelop part of the Edgar Street Stadium, the Blackfriars Stand and the West Stand, supported by funding from the provision of new commercial uses which meet the needs of the wide community of stakeholders and are complementary to the local area including the Old Market.

-

Looks like Brexit is buggered. Latest update about this evenings annoucement from The Slog - An incorrigible Cognitive Dissident. DEAD FROM DOWNING STREET: Zombie deals R Us https://hat4uk.wordpress.com/2018/11/14/dead-from-downing-street-zombie-deals-r-us/ No doubt Bobby 47 will fill in the detail!

-

How much coffee can one town drink? Council bans new cafes on high street that already has FOURTEEN on a 500-yard stretch *High street of Christchurch, Dorset has a coffee shop every 35 yards on average *Local officials have decided to leave a store empty rather than have another cafe *The town has chains Cafe Nero and Costa as well as a host of independent cafes *One owner said she was struggling to pay £2,500 rent and £1,360 business rates also Notice that Westminster city council is to ban supersize properties. Westminster city council is to ban new supersize properties built for oligarchs and other members of the global elite in order to free up space for more affordable homes for “real people”. The ban is part of Westminster’s 2019-40 development plan released on Monday night, which also included a commitment to build more than 10,000 affordable units by 2040. I suppose by affordable they mean people who can only afford a million or two. Should be able to squeeze a few more coffee shops in.

-

I spent a few years living on the army camp at Ashchurch (1955 to 1971) and together with train spotting on the local station, a pleasant period in my life. I remember walking from Ashchurch to Tewkesbury regularly before the M5 was built and there was little development between the two, just open fields.

-

Appears Tewkesbury has identified the retail problem! https://youtu.be/l_JypCXmf6s

-

The Guardian today According to this article the ideal high street customer is a person who works out in a gym, walks into town while on their mobile phone and needs their shoes repairing. Pops into a supermarket to get their tobacco or vap followed up by some time in a beauty salon and barbers and ending with a quick coffee or ice cream.

-

Another shop closing? Went past City Electrics lighting shop today, next door to The Herdsman on the corner of Widemarsh Street, and they are displaying closing down posters in their windows.

-

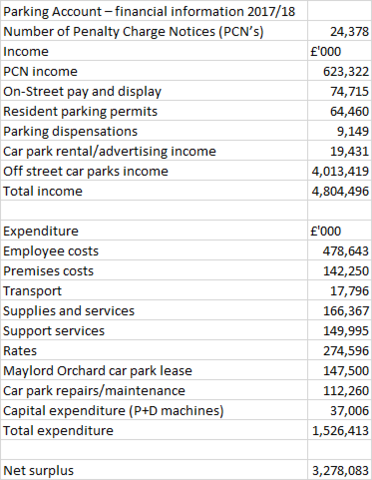

HC Made £1.9 Million Profit From Parking Charges!

megilleland replied to Bill Thomas's topic in Open Forum

Just to bring you up to date. The use of surplus funds The use of any surplus funds is governed by Section 55 of the Road Traffic Regulation Act 1984, as amended by Section 95 of the Traffic Management Act 2004, this states that any surplus in parking revenue accounts, after the cost of running the schemes has been covered can be spent on: * Providing additional parking facilities * Public transport schemes * Highway improvements * Road maintenance * Environmental improvements Income that the council receives from car parking does not have to be 'ring-fenced' for spending in the areas detailed above. The surplus in 2017/18 contributed towards highways and transport services costs. -

Quite right Ragwert. Forgotten how little green landscaping included - especially where the houses front the road.

-

How to write off student debt: my plan for Labour Danny Dorling in The Guardian today The party has promised to end tuition fees – but needs to think about young people who have already racked up £30,000 of debt In summer 2012, English tuition fees suddenly tripled to become the highest in the world. Young people choosing to go to university had no choice: for the vast majority it was huge debt or no degree. Not sure how much of this is rent for accommodation.

-

Will these measures work? From the Budget yesterday (29th October 2018) In the longer term, to support a sustainable transformation of high streets, the Plan includes a £675 million Future High Streets Fund, planning reform, a High Streets Task Force to support local leadership, and funding to strengthen community assets, including the restoration of historic buildings on high streets. Business rates public lavatories relief – The government will introduce 100% business rates relief for all public lavatories to help keep these important local amenities open. (47) Business rates local newspaper discount – The government will continue the £1,500 business rates discount for office space occupied by local newspapers in 2019-20. Local authorities will be fully compensated for the loss of income as a result of these business rates measures. More detail; 5.14 Investing in UK towns and cities Future High Streets Fund – As part of Our Plan for the High Street and alongside changes to business rates, the government will launch a new Future High Streets Fund to invest £675 million in England to support local areas to develop and fund plans to make their high streets and town centres fit for the future. This will invest in town centre infrastructure, including to increase access to high streets and support redevelopment and densification around high streets. It will include £55 million for heritage-based regeneration, restoring historic high streets to boost retail and bring properties back into use as homes, offices and cultural venues. The Fund will also establish a new High Streets Taskforce to disseminate best practice among local leaders. High streets planning – The government will consult on planning measures to support high streets to evolve. As part of this, it will consult on creating a more flexible and responsive ‘change of use’ regime with new Permitted Development Rights that make it easier to establish new mixed‑use business models on the high street. It will also trial a register of empty shops with selected local authorities, and trial a brokerage service to connect community groups to empty shops.

-

From The Budget yesterday Private Finance II (PF2) – The government has considered the Private Finance Initiative (PFI) and its successor PF2, in light of experience since 2012, and found the model to be inflexible and overly complex. The OBR’s FRR also identified private finance initiatives as a source of significant fiscal risk to government. PF2 has not been used since 2016. The Budget announces government will no longer use PF2 for new projects. A new centre of best practice in the Department of Health and Social Care (DHSC) will improve the management of existing PFI contracts. and for students: The government continues to explore options for the sale of wider corporate and financial assets, where there is no longer a policy reason to retain them and when value for money can be secured for taxpayers. This is an integral part of the government’s plan to improve the public finances: Student Loans – In December 2017 the government completed the first in its programme of sales of pre-2012 income-contingent student loans, expected to raise £12 billion by 2021-22. The sale raised £1.7 billion, reducing PSND, and was assessed as value for money by the National Audit Office. The government will now extend the sales programme by a further year, increasing total proceeds to £15 billion.

-

House builder Keepmoat signed an agreement to sell its regeneration arm to French energy services giant ENGIE for £330m in February 2017. Cabinet member contracts and assets. Thursday 24 May 2018. To approve the contractual arrangements for the development and regeneration programme In July 2017 cabinet approved Keepmoat (specifically Keepmoat Ltd) as the preferred bidder for the council’s development and regeneration programme. When Keepmoat Ltd were shortlisted for the procurement the company had two subsidiaries: Keepmoat Homes Ltd and Keepmoat Regeneration Ltd. The bid from Keepmoat Ltd proposed that the projects on the DRP would be delivered either by Keepmoat Homes Ltd or Keepmoat Regeneration Ltd depending on whether the main focus of the project was private residential properties for sale. These projects would be delivered by Keepmoat Homes Ltd and Keepmoat Regeneration Ltd. During the tender evaluation process, on 30 April 2017 a transaction took place whereby Keepmoat Ltd transferred the regeneration business of the Keepmoat Group to ENGIE Services Holding UK Limited (Engie) (registered in England and Wales with company number 08155362), a member of the ENGIE group (the ENGIE Group).

-

The Council call it a partnership. It's where public meets private.

-

Debenhams Plans to Axe 50 Branches

megilleland replied to Colin James's topic in Edgar Street Grid and Courtyard Theatre

Looking at The Valuation Office Agency (VOA) the business rates are set at: Debenhams current rateable value £665,000 - 7833 sq m Waitrose current rateable value £497,000 - 2498 sq m The Business Rate multiplier is 49.3 pence. Both have a Transitional Relief certificate. (A stay of execution?) https://www.gov.uk/correct-your-business-rates (search for HR4 9HT) In October 2015 the Government announced its intention to enable local government as a sector to retain all business rates raised locally. A Local Government Finance Bill was introduced in Parliament in January 2017 to provide enabling legislation for the reforms and the LGA provided briefing and information to MPs throughout the Bill process. The Bill did not complete its legislative stages before the 2017 general election and was subsequently not reintroduced. DCLG are considering ways in which the Government's manifesto commitment to give local government greater control over their income can be taken forward. https://www.local.gov.uk/topics/finance-and-business-rates/business-rates-retention If businesses keep closing down Herefordshire Council won't be getting any benefit from this scheme. -

Magistrates will probably be having a welcome back party. They haven't done six months yet unless it was back dated.

-

August 2018 Expense Area Cipfa(T) £40,170.00 Worcestershire County Council Corporate Employees £6,900,000.00 Worcestershire County Council Holding Codes Holding Codes £1,372.403 Worcestershire County Council Corporate Employees £2,560.53 Worcestershire County Council Corporate Employees £40,170.00 Worcestershire County Council Corporate Employees £16,334.00 Worcestershire County Council Environment and Place Supplies & Services £953,819.45 Worcestershire County Council Environment and Place Third Party Payments £1,052,339.45 Worcestershire County Council Environment and Place Third Party Payments £9.006,765.83 September 2018 Expense Area Cipfa(T) £40,170.00 Worcestershire County Council Corporate Employees £6,900,000.00 Worcestershire County Council Holding Codes Holding Codes £1,372.403 Worcestershire County Council Corporate Employees £2,560.53 Worcestershire County Council Corporate Employees £40,170.00 Worcestershire County Council Corporate Employees £16,334.00 Worcestershire County Council Environment and Place Supplies & Services £953,819.45 Worcestershire County Council Environment and Place Third Party Payments £972,417.63 Worcestershire County Council Environment and Place Third Party Payments £8,926,844.01 It appears these are regular payments each month

-

There is a link to this inquiry here. The inquiry is due to open at 10.00am on Tuesday 30th October 2018 at the Bridge Room, Hereford Left Bank, Bridge Street, Hereford, HR4 9DG.